Resources to Support Your Transition

Transitioning to the next phase of your career can be daunting, especially with all the information and documentation you may need. That’s why we’ve compiled some of the most important resources here in one easy-to-access location. From taxes to expenses and help re-entering the workforce, everything you need to move your career forward is at your fingertips.

- Benefits

For Your Benefits Help Centre

For information about Health & Insurance, Pension or Savings Plan visit the For Your Benefits website or call 1-866-769-8521, to speak with a representative.

Auto & Home Insurance

If you have policies with any of the insurance vendors for home & auto, please call to either cancel or continue coverage:

Sound Insurance Services Inc.

In Ontario and Alberta call: 1-800-763-6546

All other provinces call: 1-866-247-7700

Email: [email protected]

Company Group Insurance

If you have group life insurance coverage you may be eligible to continue some coverage through Desjardins’ conversion Privilege plan under the applicable terms. You are also eligible to apply for up to $200,000 (but not exceeding the amount of insurance you had as an active employee) of individual life insurance protection under the terms of Company group plan, without providing proof of good health. You need to contact Desjardins Insurance within 31 days of the date your Company group coverage ends for coverage continuation or to apply for an individual policy. Please call Desjardins at 1-877-385-3033, Monday to Friday, 8:00 a.m. to 5:00 p.m. (ET) for more information and/or to enroll in the Desjardin Conversion Privilege plan.

Benefits While Receiving Severance FAQ and Information

For answers to Frequently Asked Questions about benefits while receiving severance, please review FAQ included in your package. For additional information on your benefits while receiving severance please review the "My Choice Plan" document included in your severance package.

Employee Assistance Program

Click here for more information on what is available to you

- Fidelity NetBenefits (J&J Stock/LTI Awards)

If applicable, the Fidelity NetBenefits® website will continue to be available to you. Following your termination, your next account statement posted on Fidelity NetBenefits® will outline your vested Stock Options, Restricted Share Units (RSUs), and/or Performance Share Units (PSUs), the revised expiration dates of your grants, and your Stock Option/RSU/PSU ledger. It is your responsibility to review the Long-Term Incentive Plan documents (‘LTI Brochure’ on ASKGS Portal) for timelines and important details regarding your account. For the purpose of that Plan and your rights and obligations thereunder, your “Date of Termination” and your last day of active employment is your last day of work. To contact Fidelity, go to Fidelity.com/globalcall for phone numbers and dialing instructions.

- Employment Verification Process

To obtain proof of employment please contact Global Employee Service Centre by visiting:

or calling:

1-855-345-9582

- Outstanding Expense Reimbursement

To file an expense report, please follow the steps below to ensure payment in a timely fashion:

- Download the Expense Report Form

- Print name and credit card number

- Enter all of the appropriate expenses

- Explain all miscellaneous items

- Attach all original receipts greater than $25.00

- Send original report and documentation to your manager.

Please note

- Final expense reports must be submitted within 30 days of your termination date

- Out-of-pocket reimbursement funds are deposited to the banking information in your Concur profile at the time of termination. For questions please contact [email protected]

- State Job Services, Including Unemployment

Employment Insurance eligibility is determined by Service Canada. It is your responsibility to contact your local Human Resources and Social Development Canada (HRSDC) Office to inquire about eligibility rules and the application process, please contact Service

Canada directly at http://www.servicecanada.gc.ca/eng/home.shtml or at 1-800-206-7218.

Note:

The Company will electronically provide Services Canada with a Record of Employment (ROE) within 5 days of the final payment made to you.

- Employee Assistance Program (EAP)

For everything from trouble sleeping or stress to financial, work or relationship concerns, the Employee Assistance Program and WorkLife service can help. Find information about your benefits and connect with a specialist for help dealing with life's challenges.

To speak to a licensed specialist for a confidential and personal consultation to learn what is included in your benefits:

Call 1-888-307-0539

or

Visit healthymind.jnj.com

For more information download the EAP Brochure

For Your Benefits Help Centre

For information about Health & Insurance, Pension or Savings Plan visit the For Your Benefits website or call 1-866-769-8521, to speak with a representative.

Auto & Home Insurance

If you have policies with any of the insurance vendors for home & auto, please call to either cancel or continue coverage:

Sound Insurance Services Inc.

In Ontario and Alberta call: 1-800-763-6546

All other provinces call: 1-866-247-7700

Email: [email protected]

Company Group Insurance

If you have group life insurance coverage you may be eligible to continue some coverage through Desjardins’ conversion Privilege plan under the applicable terms. You are also eligible to apply for up to $200,000 (but not exceeding the amount of insurance you had as an active employee) of individual life insurance protection under the terms of Company group plan, without providing proof of good health. You need to contact Desjardins Insurance within 31 days of the date your Company group coverage ends for coverage continuation or to apply for an individual policy. Please call Desjardins at 1-877-385-3033, Monday to Friday, 8:00 a.m. to 5:00 p.m. (ET) for more information and/or to enroll in the Desjardin Conversion Privilege plan.

Benefits While Receiving Severance FAQ and Information

For answers to Frequently Asked Questions about benefits while receiving severance, please review FAQ included in your package. For additional information on your benefits while receiving severance please review the "My Choice Plan" document included in your severance package.

Employee Assistance Program

Click here for more information on what is available to you

If applicable, the Fidelity NetBenefits® website will continue to be available to you. Following your termination, your next account statement posted on Fidelity NetBenefits® will outline your vested Stock Options, Restricted Share Units (RSUs), and/or Performance Share Units (PSUs), the revised expiration dates of your grants, and your Stock Option/RSU/PSU ledger. It is your responsibility to review the Long-Term Incentive Plan documents (‘LTI Brochure’ on ASKGS Portal) for timelines and important details regarding your account. For the purpose of that Plan and your rights and obligations thereunder, your “Date of Termination” and your last day of active employment is your last day of work. To contact Fidelity, go to Fidelity.com/globalcall for phone numbers and dialing instructions.

To obtain proof of employment please contact Global Employee Service Centre by visiting:

or calling:

1-855-345-9582

To file an expense report, please follow the steps below to ensure payment in a timely fashion:

- Download the Expense Report Form

- Print name and credit card number

- Enter all of the appropriate expenses

- Explain all miscellaneous items

- Attach all original receipts greater than $25.00

- Send original report and documentation to your manager.

Please note

- Final expense reports must be submitted within 30 days of your termination date

- Out-of-pocket reimbursement funds are deposited to the banking information in your Concur profile at the time of termination. For questions please contact [email protected]

Employment Insurance eligibility is determined by Service Canada. It is your responsibility to contact your local Human Resources and Social Development Canada (HRSDC) Office to inquire about eligibility rules and the application process, please contact Service

Canada directly at http://www.servicecanada.gc.ca/eng/home.shtml or at 1-800-206-7218.

Note:

The Company will electronically provide Services Canada with a Record of Employment (ROE) within 5 days of the final payment made to you.

For everything from trouble sleeping or stress to financial, work or relationship concerns, the Employee Assistance Program and WorkLife service can help. Find information about your benefits and connect with a specialist for help dealing with life's challenges.

To speak to a licensed specialist for a confidential and personal consultation to learn what is included in your benefits:

Call 1-888-307-0539

or

Visit healthymind.jnj.com

For more information download the EAP Brochure

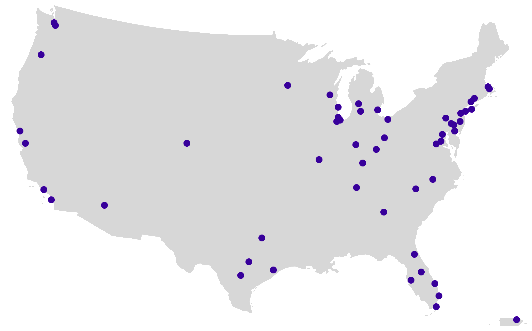

Re-enter the Workforce with Right Management®

We'll help you plan for the next step in your career through our partnership with Right Management. One of the experts at Right will reach out to you to get the process started.

The program includes:

- Support from a team of career experts, with offices in more than 50 countries

- Opportunities to network with employers, recruiters and professionals

- Assistance with updating your resume

- Guidance on interviewing skills and tips to help you excel as a candidate

- Access to technology that will support your career transition

We have arranged services for you, through Right Management. Please contact Client Services at Right Management, at 1-866-606-4225 or via e-mail at [email protected] to initiate your services. You may access this service immediately or within one year of your date of termination otherwise these services will cease to be available to you.